EHIC? Good But Not That Good!

19 Feb 2014 by Olga Brighton

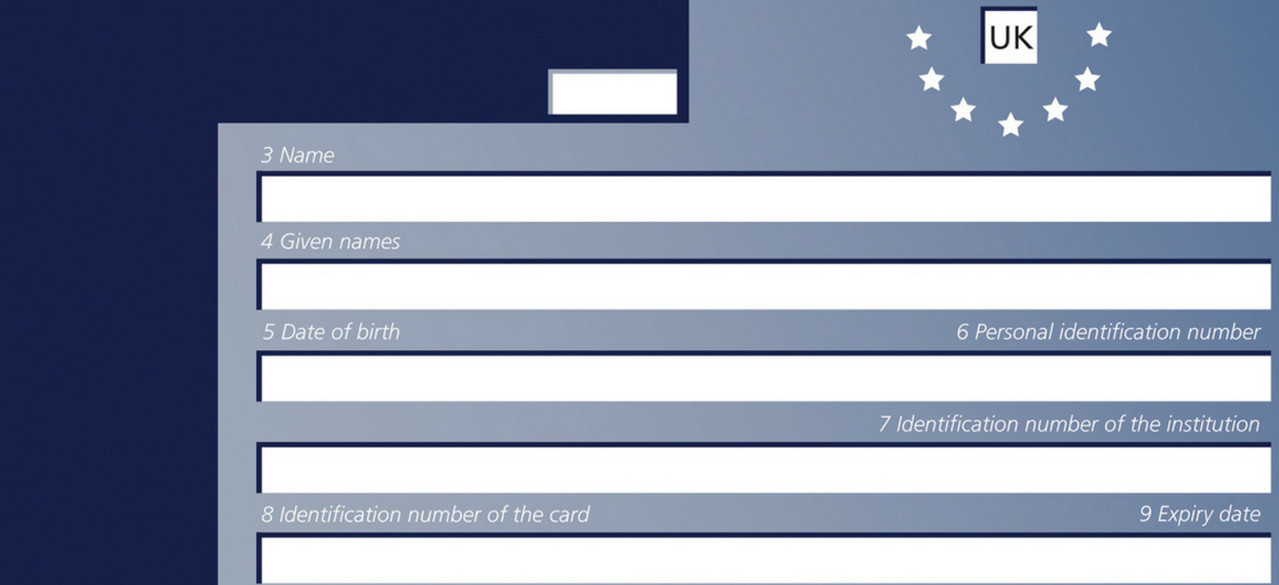

Having analysed over 1500 tie break answers to our recent competition, we were astonished just how many people believe that the European Health Insurance Card provides full protection for medical costs whilst travelling in Europe! They do not understand that the EHIC only covers the cost of certain medical treatment, leaving the traveller to settle some fairly eye watering bills themselves.

Read also: Is the EHIC Still Valid for UK Citizens in 2021?

We asked…Imagine you went on a holiday to a ski resort without any travel insurance (not that we think you would ever be that careless to leave your home without it, but just imagine). So, you are there zipping through those gorgeous mountains and something unexpected happens – you fell and broke your arm or leg. What are you going to do? Remember – you do not have travel insurance.

Obviously you would be responsible for 100% of the cost outside the countries covered by the EHIC. But even in Europe, the card only pay for the emergency treatment once you were off the mountain leaving you to pay for the rescue and recovery and the Full cost of Repatriation back Home by Air Ambulance if needed.

If you break a leg in the Alps, a trip in an air ambulance and treatment could set you back £10,000. If you have an EHIC, then that would help towards your emergency medical costs, but the cost of the helicopter rescue is likely to set you back between £1,000 and £3,500.

Add to that the additional travel cost, having missed your return flight because you were in hospital. Also, the possibility of being denied a flight home owing to the nature of your injury.

Makes the cost of a decent travel insurance policy seem insignificant, doesn’t it?

Read also: Your Quick Guide to Travel Insurance and Pre-existing Medical Conditions

We accept

.png)