How to Get a Comprehensive Travel Insurance

10 Oct 2012 by Olga Brighton

How can you purchase travel insurance from a reputable company that will cover all risks at a low cost? The answer is, you can’t.

Comprehensive Cover: Reliability + Price + Quality

Factors like Reliability, Price and Quality depend on each other. Furthermore, they depend on each other in inverse ratio. If you want a better quality, as a rule you’ll have to pay more. If you want to save a few pounds, you’ll probably have to choose a less reputable company or accept less cover and face more potential risks. Almost all market spheres include hundreds of different sellers just because the players choose different level of correlation of the elements above.

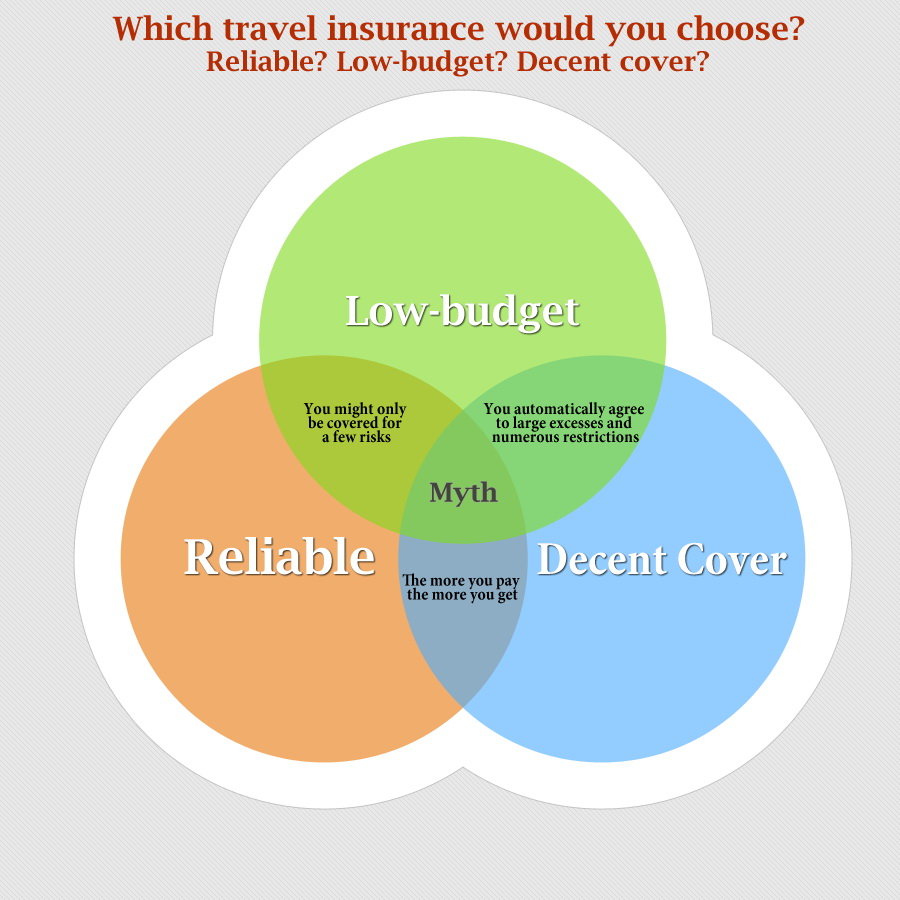

Whether you are an experienced traveler or you just start exploring the World around you, you should choose two of the three items mentioned above to get comprehensive travel insurance. Check the info graphic below to get more details about hidden dangers of different market niches.

Choose the best quality-to-price ratio

Most of travellers believe in stereotype that travel insurance is just a burden, that it is something you are obliged to have to leave your country. They don’t even guess that paying extra £10 could save thousands of pounds. For example,

- Cost of economy insurance for 8 days is £26.95. It includes just basic covers of medical expenses, missed departure, personal liability, etc.

- Cost of Comprehensive policy is £31.98 (£5.03 extra). The number of covered risks will be doubled. You’ll be covered for personal accident, hijacks, mugging, catastrophe, passport and money loss, etc.

So there is no point in comparing the covers by the total cost only. Carefully read all details of the policies, excess levels and terms and conditions of the services. A small overpay might be very profitable for you. As a rule, price difference between budget and comprehensive travel insurance policies is less than 15-20%.

Remember that perfect comprehensive travel insurance should cover you for any possible and impossible issue on a trip: from medical expenses and personal liability to all kinds of delays, cancellations, losses, catastrophes and other things that might disturb your holiday.

Choose wisely!

Read more: Your Quick Guide to Travel Insurance and Pre-existing Medical Conditions

We accept

.png)